To ensure your California Pay Data Reporting file meets the latest requirements, an update has been applied within UKG Pro to meet the Wednesday, May 8th state deadline.

The update will add three new columns to the data file:

- Number of employees that do not work remotely

- Number of remote employees located in California

- Number of remote employees not located in California

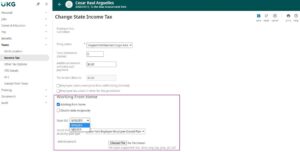

For accurate data file reporting for remote employees, administrators must select the “Working from Home” setting on the remote employees’ Income Tax page. The Working from Home functionality allows employers to designate that an employee works for a business located in one state, and the employee also performs their work from a remote location in another state. Employers can then assign State Unemployment Insurance (SUI), State Disability Insurance (SDI), and certain types of local tax types, if applicable, for either state.

Important! Please wait until at least April 5th to generate your data file for submission. Any files generated prior to this update will result in an error on the Civil Rights Department (CRD) website, since the current file format is no longer supported. For more information on the new requirements, visit the California CRD site.

Note: If you uploaded your data file prior to the update, the file would have to be manually modified to meet the latest CRD requirements.

If you have ANY questions, please contact the HCM Service Team at 407-447-3837 or via email: hcmservice@plansource.com